Philly Fed President on Fintech Innovation: Risks and Rewards - Reddit Reacts

The Philadelphia Fed's recent Fintech Conference aimed to explore the potential of financial technology, and President Paulson framed the discussion around a "win-win-win" scenario: benefits for traditional financial firms, fintech companies, and consumers. But is this optimistic outlook supported by the available data? A closer look suggests a more nuanced picture, with potential winners and losers depending on how the rapidly evolving landscape is navigated.

Fintech: Disruption or Just a Patch Upgrade?

Creative Destruction or Incremental Improvement? Paulson invoked Schumpeter's concept of "creative destruction," suggesting that fintech innovation is simply business as usual, with new ideas replacing old ones. However, she also pointed to research indicating that most innovation comes from existing firms improving their own products and services. This raises a critical question: is fintech truly disruptive, or is it primarily an incremental improvement driven by established players? The data presented from a Philly Fed study suggests the latter. Banks partnering with fintechs were able to offer larger credit lines to customers with low or missing credit scores and *improved* their credit risk assessment. This isn't necessarily "creative destruction," but rather established institutions leveraging new technologies to refine existing processes. The study out of India, showing expanded access to credit through broadband and digital payment systems, paints a similar picture. Fintech firms led the way, but credit growth didn't come at the expense of higher default rates. It appears fintech's initial promise of democratizing finance and disrupting established power structures is being tempered by the reality of integration within the existing financial system. This isn't inherently negative, but it does suggest that the "win-win-win" narrative might be overlooking potential distributional effects. Who truly benefits from these partnerships, and at whose expense? Are the gains shared equitably, or do they primarily accrue to the established players with the capital and infrastructure to integrate these new technologies?Fintech Regulation: A Tightrope Walk Over Murky Data

The Regulatory Tightrope The conference also addressed the need for regulatory clarity in the fintech space. Paulson noted that existing regulatory structures can be built upon, but new approaches will also be required. This is where things get tricky. The challenge lies in striking a balance between fostering innovation and mitigating risks. Over-regulation could stifle growth and prevent fintech from reaching its full potential. Under-regulation, on the other hand, could lead to consumer harm, financial instability, and systemic risks. 【Personal Aside】 This is the part of the conference discussion that I find the most crucial, and, frankly, the most anxiety-inducing. The history of financial innovation is littered with examples of regulatory failures that led to disastrous consequences. The key, as Paulson emphasized, is to create a level playing field where traditional financial firms and fintechs can compete fairly. But what does that actually *look* like in practice? How do you ensure that regulations are technology-neutral and don't inadvertently favor one type of player over another? And how do you adapt those regulations to keep pace with the rapid pace of technological change? The focus on stablecoins is particularly relevant here. The potential for stablecoins to compete directly with traditional bank deposits raises fundamental questions about the future of banking and the role of central banks. If stablecoins become widely adopted, what impact will that have on monetary policy and financial stability? And how do you ensure that stablecoins are adequately regulated to prevent illicit activity and protect consumers? These are complex questions with no easy answers. The mention of the Bank of Bird-in-Hand, catering to the Amish community with horse-and-buggy access, highlights the need for a nuanced approach to financial innovation. Not all innovation is digital, and not all consumers are clamoring for the latest technological advancements. Some consumers simply want reliable, accessible financial services that meet their specific needs. The challenge for regulators is to create a framework that accommodates both the cutting edge and the time-tested. The Real Winners and Losers? Ultimately, the success of fintech will depend on whether it can deliver tangible benefits to consumers, businesses, and the broader economy. Paulson suggested that success will be measured by broader financial inclusion, the expansion of products and services to diverse consumers, and fluid regulatory frameworks. But these are aspirational goals, not guarantees. The data suggest that fintech has the *potential* to achieve these goals, but realizing that potential will require careful planning, thoughtful regulation, and a willingness to address the potential downsides. The "win-win-win" narrative is appealing, but it's important to recognize that the reality is likely to be more complex. There will be winners and losers, and the challenge is to ensure that the benefits of fintech are shared widely and that the risks are managed effectively. It's worth noting (parenthetical clarification) that the conference itself attracted around 1,940 attendees, mostly online, suggesting a significant level of interest in the topic. But interest doesn't necessarily translate into positive outcomes. It's up to regulators, innovators, and users to make choices that will shape the future of finance and determine whether fintech truly lives up to its promise. Fintech's "Win-Win-Win": More of a "Maybe-Maybe-Maybe" The data suggests that fintech's promise is contingent, not guaranteed. We need more hard numbers before uncorking the champagne.Related Articles

Hims Stock: Earnings, Weight Loss Drugs, and the Telehealth Revolution

Hims & Hers: From Niche Telehealth to a Mainstream Revolution? Okay, folks, let's dive into somethin...

Halliburton's Automation Push: Shell's Agreement and Investor Shock – What Reddit is Saying

Halliburton's Wall Street Glow-Up: Smoke and Mirrors, or a Real Turnaround? Halliburton's been getti...

Nvidia News Today: Michael Burry's AI Stock Bet and What We Know

Generated Title: Burry's AI Short: Genius or Just a Gut Feeling? Here's What the Numbers Say The Big...

Target's Big Reset: The Hidden Signal for a Smarter Future of Retail

Imagine the silence. One moment, you’re a corporate employee at Target’s sprawling Minneapolis headq...

Gold Price Analysis: Today's Price, Key Metrics, and the Silver Correlation

Gold's Dizzying Climb to $4,000: A Sober Look at the Numbers Behind the Hype The numbers flashing ac...

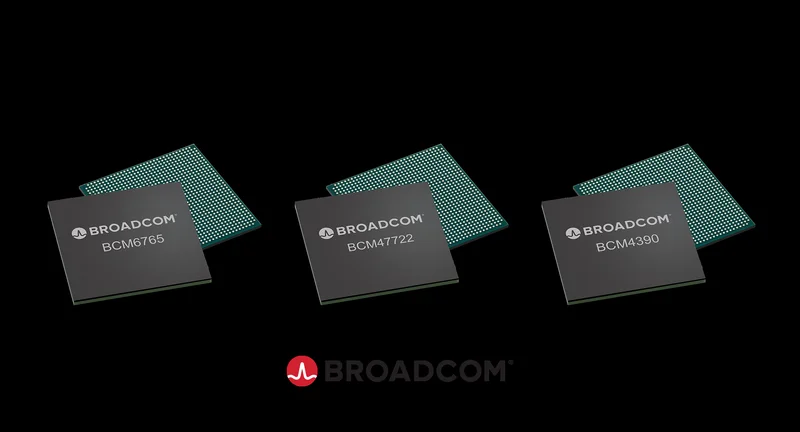

Broadcom's OpenAI Sugar Rush: Why I'm Not Buying a Single Share

Another Monday, another multi-billion dollar AI deal that we're all supposed to applaud like trained...