VIX: What it is, what's happening, and why the 'fear gauge' is spiking

The VIX Ain't Just Spiking, Folks – It's a Scream into the Void

Alright, let's cut the crap. You see the headlines, right? The VIX, Wall Street's beloved "fear gauge," is doing its best impression of a rocket launch. It shot up to 27.8, closing around 26.3, and yeah, it dipped a little on Friday to 25.30. Big whoop. That's still higher than it's been since that whole "Liberation Day" tariff fiasco back in April when Trump decided to play global economic chicken. Remember that? The VIX went over 50 then. This time, it's not a single policy blunder. This time, it feels… different. More insidious, maybe? Or am I just getting old and cranky... no, I'm not. This is legit.

They always tell you these spikes are short-lived. "Buy the dip!" they shout from their gilded towers. But what if the dip is just the first step down a very long, very dark staircase? We're talking a 50% jump in November alone. That’s only the 11th time in history this thing has climbed that hard in a month. It means investors are paying through the nose for S&P 500 options to protect their portfolios, like buying flood insurance when the levee's already got cracks. I mean, what do they know that we don't? Or is it just a collective panic attack, a ripple spreading through the trading floors, making every monitor glow with that sickly green of falling numbers? You can practically hear the subtle, high-pitched hum of a thousand servers processing bad news, while some poor intern spills their overpriced latte.

What's Got 'Em Spooked This Time? (Spoiler: Same Old BS)

So, why the sudden case of the market jitters? It ain't tariffs this time, thank god. Or, no, that's not quite right—it's not just tariffs. This time around, we're talking about a cocktail of bad vibes. First up: those glorious tech valuations. Seriously, how many times are we gonna do this dance? Companies like Nvidia are printing money, sure, but their price-to-earnings multiples are hitting levels we haven't seen since the goddamn dot-com bubble. Remember that? Everyone thought Pets.com was the future, and then poof. We're being told that AI-fueled gains are real, they're sustainable, they're the new paradigm. But what if they're just a sugar rush? A speculative fever dream that's gonna leave us all with a nasty hangover.

And then there's the Fed, always the Fed. Jerome Powell, bless his heart, decided to pump the brakes on rate cuts. He basically yanked the rug out from under all those "risk assets" that had been propping up the market since April's lows. For a minute, money markets were only giving a 40% chance of a December cut. Then New York Fed President John Williams opened his mouth with some "dovish comments," and suddenly, it's a 73% chance. Give me a break. These guys are like a bad DJ, constantly scratching the record, trying to figure out if they should speed up or slow down. It just creates more market volatility, more uncertainty, more reasons for the VIX index to scream. Are they playing some kind of twisted game, trying to see how much whiplash they can induce before someone throws a chair?

The "Perfect Storm" and Who Gets Wet

Look, they're calling this a "perfect storm" of uncertainty. Tech valuations, interest rates, and escalating geopolitical tensions. It's a phrase designed to sound important, isn't it? Like something out of a disaster movie. But what it really means is that the big boys on Wall Street don't have a clue what's coming next, and they're hedging their bets like crazy. The average Joe with his 401k, though? He's just along for the ride, hoping his retirement fund doesn't get swept out to sea.

They say these VIX spikes create "opportunity" for long-term investors. Buying the dip, right? That's what the gurus always preach. But buying the dip when the market's footing is shakier than a newborn deer on ice? That's not opportunity; that's just gambling with a fancy name. This isn't like April, where there was one clear villain – Trump's tariffs. This time, it's a fog of war, a general sense of unease. It's the market collectively looking at the future and going, "Ehh, not so sure about that." We're talking about fundamental questions: Is AI really worth this much? Is the Fed gonna screw us again? Will the world finally just calm down for five minutes? I'd love to tell you I have answers, but honestly... I'm just here to point out the emperor's new clothes.

Just Another Day in the Casino, Folks

So, here we are. The VIX is high, the market's nervous, and everyone's pretending they know what's going on. It's just another Tuesday in the grand casino they call Wall Street. Don't let anyone tell you different.

Previous Post:Bitcoin: Price Swings, USD Value, and What We Know

Next Post:Oracle Stock: Why It Sank

Related Articles

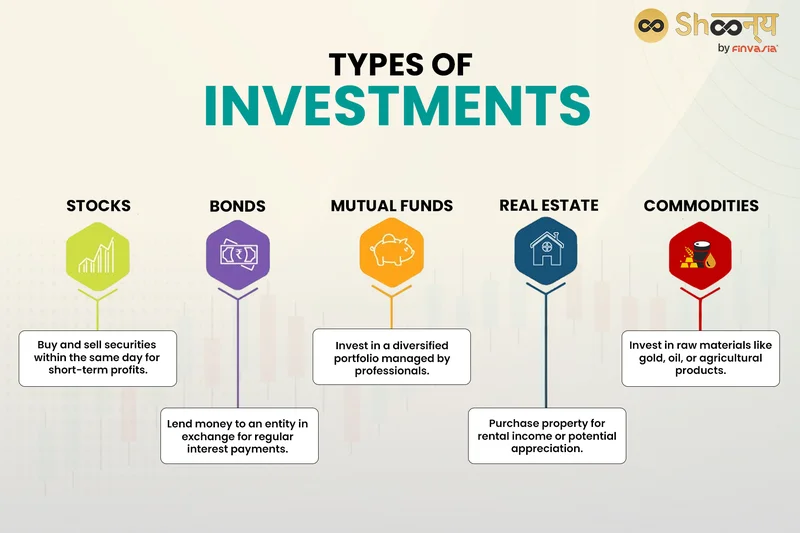

Analyzing 2025's Investment Landscape: What the Data Reveals About Top Asset Classes vs. Low-Risk Alternatives

There's a quiet, pervasive myth circulating among the baby boomer generation as they navigate retire...

Forge Global Acquired: What Happened and Why?

Schwab's picking up Forge Global for $660 million. Let's be real, that's not an acquisition, it's a...

The D-Wave (QBTS) Quantum Breakthrough: What This Surge *Really* Means for the Future

Of course. Here is the feature article, written from the persona of Dr. Aris Thorne. * You’ve seen t...

Powell's Speech: Decoding the Market Impact and Future Rate Cuts

All eyes are on Washington, D.C. tomorrow. Not on Congress, not on the White House, but on a single...

IRS Relief Payment 2025: The 'Direct Deposit' Reality Check

Uncle Sam's Shell Game: Don't Hold Your Breath for That November Windfall Alright, folks, let’s be r...

Kimberly Clark's $48.7 Billion Deal: What It Means – What Reddit is Saying

Kimberly-Clark Swallows Kenvue: A $48.7 Billion Gamble Kimberly-Clark is betting big on a reunion. T...